Последние темы

Похожие темы

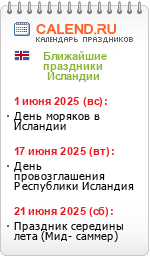

Праздники Исландии

Вход

‘British offer to guarantee Icesave declined by Iceland Central Bank’

Страница 1 из 1

‘British offer to guarantee Icesave declined by Iceland Central Bank’

‘British offer to guarantee Icesave declined by Iceland Central Bank’

Bjorgolfur Thor Bjorgolfsson, a major shareholder of Landsbanki, said this week that deposits with the collapsed savings brand Icesave could have been guaranteed by the UK if the Icelandic Central Bank had agreed to back a British transfer plan with a multi-million pound guarantee.

In the interview, which was broadcast on the Icelandic news programme Kompas on Monday night, Bjorgolfsson revealed that the day before Landsbanki was nationalised in Iceland, the UK Financial Supervisory Authority had offered to accept Icesave deposits under a British guarantee within 5 days, provided Landsbanki submitted GBP 200 million in collateral from the Icelandic Central Bank.

Bjorgolfsson suggested that the Central Bank’s refusal to grant Landsbanki the loan, which would have allowed them to accept the British offer, might have been the trigger behind the seizure of Icelandic bank assets in the UK which many believe led to the total collapse of the Icelandic banking system.

According to Bjorgolfsson, the Icelandic government therefore bears considerable responsibility for the collapse of Icesave and for plunging the country into an international dispute.

“Icesave could have been tackled very differently, “said Bjorgolfsson. “The Icesave issue would not be a problem, but part of a solution to the crisis that has now hit Iceland. And by that I mean that in a crisis like this, the responses to the problems are actually more important and have greater consequences than the problem itself”.

In Bjorgolfsson’s opinion the Icelandic Central Bank could have prevented the uncertainty surrounding the Icesave deposits in the UK and the subsequent clash between Iceland and Britain which caused considerable damage to Iceland’s reputation in the UK.

The Icelandic Prime Minister Geir Haarde and Minister of Industry Ossur Skarphedinsson have both denied knowledge of the British offer. The Central Bank has responded by saying, “the reason for Landsbanki’s request [for a GBP 200 million loan] was outflow from deposit accounts. An express treatment by the British Financial Supervisory Authority was never mentioned.”

Bjorgolfsson has rejected these claims, saying that “the directors of the Central Bank had full knowledge of the British Financial Supervisory Authority’s offer to fast track the loan and that can also be confirmed by others. Government ministers who have been solving the problems of Icelandic financial companies were also aware of the offer made by the British authorities.”

icenews.is

In the interview, which was broadcast on the Icelandic news programme Kompas on Monday night, Bjorgolfsson revealed that the day before Landsbanki was nationalised in Iceland, the UK Financial Supervisory Authority had offered to accept Icesave deposits under a British guarantee within 5 days, provided Landsbanki submitted GBP 200 million in collateral from the Icelandic Central Bank.

Bjorgolfsson suggested that the Central Bank’s refusal to grant Landsbanki the loan, which would have allowed them to accept the British offer, might have been the trigger behind the seizure of Icelandic bank assets in the UK which many believe led to the total collapse of the Icelandic banking system.

According to Bjorgolfsson, the Icelandic government therefore bears considerable responsibility for the collapse of Icesave and for plunging the country into an international dispute.

“Icesave could have been tackled very differently, “said Bjorgolfsson. “The Icesave issue would not be a problem, but part of a solution to the crisis that has now hit Iceland. And by that I mean that in a crisis like this, the responses to the problems are actually more important and have greater consequences than the problem itself”.

In Bjorgolfsson’s opinion the Icelandic Central Bank could have prevented the uncertainty surrounding the Icesave deposits in the UK and the subsequent clash between Iceland and Britain which caused considerable damage to Iceland’s reputation in the UK.

The Icelandic Prime Minister Geir Haarde and Minister of Industry Ossur Skarphedinsson have both denied knowledge of the British offer. The Central Bank has responded by saying, “the reason for Landsbanki’s request [for a GBP 200 million loan] was outflow from deposit accounts. An express treatment by the British Financial Supervisory Authority was never mentioned.”

Bjorgolfsson has rejected these claims, saying that “the directors of the Central Bank had full knowledge of the British Financial Supervisory Authority’s offer to fast track the loan and that can also be confirmed by others. Government ministers who have been solving the problems of Icelandic financial companies were also aware of the offer made by the British authorities.”

icenews.is

_________________

ООО "АйсКорпо Рус" www.icecorpo.is

Школа русского языка в Исландии www.modurmal.com

Похожие темы

Похожие темы» PRESS RELEASE FROM THE CENTRAL BANK OF ICELAND:

» Central Bank of Iceland Lowers Policy Rate

» Foreign Minister Criticizes Central Bank Chairman

» Central Bank of Iceland Lowers Policy Rate

» Foreign Minister Criticizes Central Bank Chairman

Страница 1 из 1

Права доступа к этому форуму:

Вы не можете отвечать на сообщения

» FAQ или часто задаваемые вопросы

» Шторм на Ладоге

» У моря в апреле

» Ты будешь жить

» 67-я параллель

» Тиманский овраг

» Отель "Ореанда"

» Карельские рассветы

» Альма-Матер