Последние темы

Похожие темы

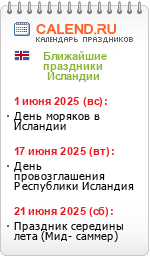

Праздники Исландии

Вход

Iceland Reaches Agreement with IMF

Страница 1 из 1

Iceland Reaches Agreement with IMF

Iceland Reaches Agreement with IMF

Iceland has reached an agreement with the International Monetary Fund (IMF) on a comprehensive economic stabilization program including a USD 2 billion (EUR 1.6 billion) loan from the fund, as announced by the Icelandic government this afternoon.

The program requires approval from the management of the IMF. “We are confident that the IMF's management will support the program and submit it for approval by the IMF's executive board as soon as possible,” reads a press release issued by the Icelandic government on this matter.

Iceland would be able to draw USD 830 million (EUR 662 million) immediately after the IMF board approves the program. It is also expected that an agreement with the IMF will encourage lending from other sources.

"This program will enable us to secure funding and gain access to the necessary technical expertise required to stabilize the Icelandic króna and to provide support for the development of a healthier financial system. As a result, Iceland will commit to a sustainable long-term economic policy, and a plan for the recovery of the Icelandic economy. A thorough review of the Icelandic banking regulatory framework will also form part of this program," said Prime Minister Geir H. Haarde.

"With our announcement today of our intention to cooperate with the IMF, Iceland is now in a much better position to establish a sound economic and financial base for the country. We would like to thank all those who have assisted us in these dark days and we now have grounds for a more optimistic view of the future," the prime minister added.

"The Icelandic government has taken decisive measures and is working hard to solve the problems it is facing. We realize that the immediate future remains challenging due to the global financial crisis but I am convinced that international cooperation and solidarity is essential for us to recover, reform and regain Iceland’s good reputation abroad,” commented Foreign Minister Ingibjörg Sólrún Gísladóttir.

“We are confident that the prospective support of the IMF will provide the necessary impetus for some of our friends and allies in the international system to contribute to the reconstruction of the Icelandic financial system," Gísladóttir concluded.

The objectives of the program are as follows, according to the Government of Iceland press release:

1. Restore confidence in the Icelandic economy and stabilize the Icelandic króna through a comprehensive and strong macro-economic program;

2. Restore fiscal sustainability and prepare a strong medium-term fiscal consolidation program;

3. Implement a sound banking strategy to re-establish a viable banking system to support the Icelandic economy.

The short term stabilization of the exchange rate is essential in order to get inflation under control and normalize business conditions, particularly with regard to foreign trade. This will be achieved by reintroducing a flexible exchange rate regime backed up by strong foreign currency reserves and the full commitment of the Central Bank of Iceland to apply the means necessary to get the desired results.

Given the relatively large depreciation that has already taken place, and the contraction in domestic demand which is expected, there is little doubt that following the initial stabilization period, a significant currency appreciation is to be expected. However, the exchange rate may show considerable volatility in the beginning, which the program is designed to address.

Another main objective of our program is to create sound fiscal strategies given the extraordinary challenge that public finances in Iceland are now facing as a result of the cost of bank restructuring and the inevitable revenue loss as the economy slows down.

To obtain the fiscal objectives there will be a need to limit the discretionary relaxation in the current budget proposal and to implement significant tightening of the structural balance in the medium term, which is a necessary precondition for a sustainable growth path of the Icelandic economy.

Finally, our program aims to facilitate the creation of a sound banking system for Iceland by a series of reforms regarding operational procedures as well as a revision of financial regulation in accordance with international best-practice. This will include, among other things, revised articles of bank insolvency as well as general insolvency rules.

Further details of the program will not be released until it has been accepted by the IMF board, Gísladóttir announced at a press conference this afternoon.

icelandreview.com

The program requires approval from the management of the IMF. “We are confident that the IMF's management will support the program and submit it for approval by the IMF's executive board as soon as possible,” reads a press release issued by the Icelandic government on this matter.

Iceland would be able to draw USD 830 million (EUR 662 million) immediately after the IMF board approves the program. It is also expected that an agreement with the IMF will encourage lending from other sources.

"This program will enable us to secure funding and gain access to the necessary technical expertise required to stabilize the Icelandic króna and to provide support for the development of a healthier financial system. As a result, Iceland will commit to a sustainable long-term economic policy, and a plan for the recovery of the Icelandic economy. A thorough review of the Icelandic banking regulatory framework will also form part of this program," said Prime Minister Geir H. Haarde.

"With our announcement today of our intention to cooperate with the IMF, Iceland is now in a much better position to establish a sound economic and financial base for the country. We would like to thank all those who have assisted us in these dark days and we now have grounds for a more optimistic view of the future," the prime minister added.

"The Icelandic government has taken decisive measures and is working hard to solve the problems it is facing. We realize that the immediate future remains challenging due to the global financial crisis but I am convinced that international cooperation and solidarity is essential for us to recover, reform and regain Iceland’s good reputation abroad,” commented Foreign Minister Ingibjörg Sólrún Gísladóttir.

“We are confident that the prospective support of the IMF will provide the necessary impetus for some of our friends and allies in the international system to contribute to the reconstruction of the Icelandic financial system," Gísladóttir concluded.

The objectives of the program are as follows, according to the Government of Iceland press release:

1. Restore confidence in the Icelandic economy and stabilize the Icelandic króna through a comprehensive and strong macro-economic program;

2. Restore fiscal sustainability and prepare a strong medium-term fiscal consolidation program;

3. Implement a sound banking strategy to re-establish a viable banking system to support the Icelandic economy.

The short term stabilization of the exchange rate is essential in order to get inflation under control and normalize business conditions, particularly with regard to foreign trade. This will be achieved by reintroducing a flexible exchange rate regime backed up by strong foreign currency reserves and the full commitment of the Central Bank of Iceland to apply the means necessary to get the desired results.

Given the relatively large depreciation that has already taken place, and the contraction in domestic demand which is expected, there is little doubt that following the initial stabilization period, a significant currency appreciation is to be expected. However, the exchange rate may show considerable volatility in the beginning, which the program is designed to address.

Another main objective of our program is to create sound fiscal strategies given the extraordinary challenge that public finances in Iceland are now facing as a result of the cost of bank restructuring and the inevitable revenue loss as the economy slows down.

To obtain the fiscal objectives there will be a need to limit the discretionary relaxation in the current budget proposal and to implement significant tightening of the structural balance in the medium term, which is a necessary precondition for a sustainable growth path of the Icelandic economy.

Finally, our program aims to facilitate the creation of a sound banking system for Iceland by a series of reforms regarding operational procedures as well as a revision of financial regulation in accordance with international best-practice. This will include, among other things, revised articles of bank insolvency as well as general insolvency rules.

Further details of the program will not be released until it has been accepted by the IMF board, Gísladóttir announced at a press conference this afternoon.

icelandreview.com

_________________

ООО "АйсКорпо Рус" www.icecorpo.is

Школа русского языка в Исландии www.modurmal.com

Похожие темы

Похожие темы» Iceland and Norway Sign Agreement on Fossil Fuel

» Icelandic and Faroese Ministers Sign Agreement

» Practical information about Iceland

» Icelandic and Faroese Ministers Sign Agreement

» Practical information about Iceland

Страница 1 из 1

Права доступа к этому форуму:

Вы не можете отвечать на сообщения

» FAQ или часто задаваемые вопросы

» Шторм на Ладоге

» У моря в апреле

» Ты будешь жить

» 67-я параллель

» Тиманский овраг

» Отель "Ореанда"

» Карельские рассветы

» Альма-Матер