Последние темы

Похожие темы

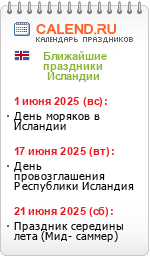

Праздники Исландии

Вход

Iceland’s richest man defends economic record

Страница 1 из 1

Iceland’s richest man defends economic record

Iceland’s richest man defends economic record

Following a prolonged silence from many of Iceland’s most-recognised businesspeople in the wake of the country’s economic collapse, the billionaire father and son duo Bjorgolfur Gudmundsson and Bjorgolfur Thor Bjorgolfsson have both given in-depth media interviews this week.

Former majority owner and chairman of Landsbanki, Bjorgolfur Gudmundsson appeared in an 11 page interview in the Morgunbladid newspaper on Sunday. Meanwhile, his son, Bjorgolfur Thor Bjorgolfsson was featured in Stod 2’s popular Kompas news programme on Monday.

Bjorgolfsson has, or had at one time or another, major investments in most of Iceland’s biggest companies. He remains chairman of Straumur Investment Bank and of Actavis. Many have accused him and his father of being key culprits in Iceland’s rapid economic decline.

In Monday’s television interview, Bjorgolfsson was not abashed. In his opinion, despite any mistakes he may have made, he should not be held responsible for the economy today.

According to Bjorgolfsson, the Landsbanki board bear a lot of responsibility for the bank’s collapse; but also the Icelandic government:

“The authorities carry a responsibility for how they tackled the issue. Icesave could have been tackled very differently so this Icesave issue would not be an issue but a part of a solution of this crisis that now has hit Iceland. And by that I mean that in a crisis like this the responses to the problems are actually more important and have greater consequences than the problem itself,” he said.

Defending Landsbanki’s decision to set up Icesave in 2006 to rescue itself from early trouble, Bjorgolfsson said:

“There were foreign rating companies, there were the banks, and there were top specialists, control organisations and others that said: you must increase deposits, you must increase deposits – you cannot just rely on foreigners to lend you money. All right, deposits must increase. Now, there are only some 300,000 Icelanders so you cannot turn to Icelandic funds, so an overseas deposit system had to be implemented. And let‘s remember that in the latter half of 2006 these deposit systems that were started did fully rescue the Icelandic banking system from that crisis. In 2007 the Icelandic banks were applauded for this and Landsbanki had done most in this respect and had acquired most deposits. It was the most highly rated bank by the international rating companies and considered the least risky of the banks because of all the deposit accounts.”

“And when (Icesave) began to grow big, people started saying ‘shouldn‘t we start examining whether this should be an Icelandic or a foreign bank’. And these talks were ongoing and transferring things over to England was being done… when in fact everything became disconnected that Monday by the nationalisation.”

Later in the interview, Bjorgolfsson reveals for the first time that the day before the Emergency Act was approved in Iceland; the British had made an about-face and offered to accept Icesave under a British guarantee in 5 days against a guarantee from the Central Bank of Iceland. This had been rejected by the Central Bank, resulting in the collapse of the remainder of the Icelandic banking system and the country plunging into a harsh international dispute. Bjorgolfur Thor asserts that the previous weekend the authorities had not even replied to offers that would have stopped the nationalisation of Glitnir and prevented the banking system‘s fateful collapse. The government and Central Bank of Iceland deny the allegations.

He also argues that the government set up a terrible chain of events right at the beginning of the crisis when the state took control of Glitnir Bank.

“This was a terrible chain of events: a terrible chain of events resulting in a disaster. It is the disaster we are in today as a nation. I was incidentally in Iceland at a wedding when I received a phone call from people telling me that Glitnir had run into trouble and that the Central Bank will probably attempt to take it over,” Bjorgolfsson recalls. “Then all kinds of discussions started and Landsbanki‘s shareholders were asked to talk with Glitnir‘s shareholders and talk with the Central Bank. (Our opinion was that) by taking over the whole bank the State is assuming the whole responsibility. This must not happen. This was the message from Landsbanki and Kaupthing that were outside this: this must not happen, this is terrible. Then private enterprise, i.e. the banks, came up with ideas and we submitted them to the PM, we submitted them to the Central Bank on that Sunday, we repeated them the following Monday and we always made changes, (but) we got no reply. I am not saying that they were rejected, we just received no answers, they were not considered worthy of reply. And our suggestions were inherently exactly the same suggestions that were made here in England, i.e. to effect the merger of all the banks, Landsbanki/Glitnir/ and Landsbanki/Glitnir/Straumur, all to be merged, to aggregate their equity to cut costs with the State also injecting capital and acquiring a majority stake, yet not become responsible. Now everybody is saying: ‘how is the State responsible?’”

icenews.is

Former majority owner and chairman of Landsbanki, Bjorgolfur Gudmundsson appeared in an 11 page interview in the Morgunbladid newspaper on Sunday. Meanwhile, his son, Bjorgolfur Thor Bjorgolfsson was featured in Stod 2’s popular Kompas news programme on Monday.

Bjorgolfsson has, or had at one time or another, major investments in most of Iceland’s biggest companies. He remains chairman of Straumur Investment Bank and of Actavis. Many have accused him and his father of being key culprits in Iceland’s rapid economic decline.

In Monday’s television interview, Bjorgolfsson was not abashed. In his opinion, despite any mistakes he may have made, he should not be held responsible for the economy today.

According to Bjorgolfsson, the Landsbanki board bear a lot of responsibility for the bank’s collapse; but also the Icelandic government:

“The authorities carry a responsibility for how they tackled the issue. Icesave could have been tackled very differently so this Icesave issue would not be an issue but a part of a solution of this crisis that now has hit Iceland. And by that I mean that in a crisis like this the responses to the problems are actually more important and have greater consequences than the problem itself,” he said.

Defending Landsbanki’s decision to set up Icesave in 2006 to rescue itself from early trouble, Bjorgolfsson said:

“There were foreign rating companies, there were the banks, and there were top specialists, control organisations and others that said: you must increase deposits, you must increase deposits – you cannot just rely on foreigners to lend you money. All right, deposits must increase. Now, there are only some 300,000 Icelanders so you cannot turn to Icelandic funds, so an overseas deposit system had to be implemented. And let‘s remember that in the latter half of 2006 these deposit systems that were started did fully rescue the Icelandic banking system from that crisis. In 2007 the Icelandic banks were applauded for this and Landsbanki had done most in this respect and had acquired most deposits. It was the most highly rated bank by the international rating companies and considered the least risky of the banks because of all the deposit accounts.”

“And when (Icesave) began to grow big, people started saying ‘shouldn‘t we start examining whether this should be an Icelandic or a foreign bank’. And these talks were ongoing and transferring things over to England was being done… when in fact everything became disconnected that Monday by the nationalisation.”

Later in the interview, Bjorgolfsson reveals for the first time that the day before the Emergency Act was approved in Iceland; the British had made an about-face and offered to accept Icesave under a British guarantee in 5 days against a guarantee from the Central Bank of Iceland. This had been rejected by the Central Bank, resulting in the collapse of the remainder of the Icelandic banking system and the country plunging into a harsh international dispute. Bjorgolfur Thor asserts that the previous weekend the authorities had not even replied to offers that would have stopped the nationalisation of Glitnir and prevented the banking system‘s fateful collapse. The government and Central Bank of Iceland deny the allegations.

He also argues that the government set up a terrible chain of events right at the beginning of the crisis when the state took control of Glitnir Bank.

“This was a terrible chain of events: a terrible chain of events resulting in a disaster. It is the disaster we are in today as a nation. I was incidentally in Iceland at a wedding when I received a phone call from people telling me that Glitnir had run into trouble and that the Central Bank will probably attempt to take it over,” Bjorgolfsson recalls. “Then all kinds of discussions started and Landsbanki‘s shareholders were asked to talk with Glitnir‘s shareholders and talk with the Central Bank. (Our opinion was that) by taking over the whole bank the State is assuming the whole responsibility. This must not happen. This was the message from Landsbanki and Kaupthing that were outside this: this must not happen, this is terrible. Then private enterprise, i.e. the banks, came up with ideas and we submitted them to the PM, we submitted them to the Central Bank on that Sunday, we repeated them the following Monday and we always made changes, (but) we got no reply. I am not saying that they were rejected, we just received no answers, they were not considered worthy of reply. And our suggestions were inherently exactly the same suggestions that were made here in England, i.e. to effect the merger of all the banks, Landsbanki/Glitnir/ and Landsbanki/Glitnir/Straumur, all to be merged, to aggregate their equity to cut costs with the State also injecting capital and acquiring a majority stake, yet not become responsible. Now everybody is saying: ‘how is the State responsible?’”

icenews.is

Последний раз редактировалось: Admin (Сб Ноя 01, 2008 11:58 am), всего редактировалось 1 раз(а)

_________________

ООО "АйсКорпо Рус" www.icecorpo.is

Школа русского языка в Исландии www.modurmal.com

Interview with Bjorgolfur Thor Bjorgolfsson

Interview with Bjorgolfur Thor Bjorgolfsson

Iceland‘s richest man, Björgólfur Thor Björgólfsson, is now under heavy criticism. He is accused of being partially responsible for the collapse of the Icelandic economy. Here he responds to this criticism, at the same time he is outspoken about the role of the government and the Central Bank. He tells about what happened behind the curtains during those fateful days when the Icelandic economy was on the brink of a collapse and accuses the authorities of making completely wrong decisions, despite serious warnings. He says it was a terrible mistake to nationalise Glitnir and tells also about how the authorities ignored his offer to be released from the IceSave guarantees on the same day the emergency act was implemented in Iceland. Björgólfur Thor believes this explains the violent British response and the countries‘ serious international dispute.

Landsbanki was placed on UK‘s terrorism list along with al-Qaeda, Sudan, North Korea and the Taliban. The British demand the Icelandic nation to guarantee ISK hundreds of millions worth of Landsbanki‘s IceSave deposit accounts. A massive anger has risen among the Icelandic people towards father and son Björgólfurs. They demand nationalisation and expropriation, or at least a social and moral responsibility from them. Kristinn Hrafnsson interviewed Björgólfur Thor in London last Friday.

The nation‘s devastating economic collapse has generated massive anger among the nation, including towards the men who bought Landsbanki six years ago. In an interview last Friday the Prime Minister urged the tycoons to bring their wealth to Iceland to participate in the build-up and so did the Foreign Minister in TV program Kastljós. Earlier the Minister of Trade had referred to Björgólfur Thor saying that a social and moral duty rested on his shoulders to bring his money back to Iceland. The opposition parties want to examine the possibility of expropriation. Wrath and anger simmers among the people, with Björgólfur Thor being among those it is directed at. The animosity does not escape him even though he lives in London where Kompás met him last Friday.

Björgólfur Thor Björgólfsson, investor: I understand that people are angry now, as there is total uncertainty. Will this guarantee fall on Iceland? What is going to happen to the banks? What is going to happen concerning the loan? What is going to happen to the currency exchange? Iceland is in total uncertainty today. When there is uncertainty, total uncertainty, it manifests in two ways, fear and anger. And now people are just totally consumed by fear and anger and I fully understand that. I am both hurt and angry and scared. I mainly fear that the Icelandic authorities, when they took the measures they did, have not realised what forces they unleashed and I fear that they do not understand the long term effects of it on the economy and what remedies there are. I also want to point out concerning the remarks by (Minister of Trade) Björgvin (G. Sigurðsson), which I have not seen but heard of, that moral responsibility is a very subjective concept and I am not going to shun any responsibility, but it is not his to tell what the responsibility is. It is fine for him to direct the attention to us and away from himself. I am not going to personify, but I understand the anger and I think the key issue is: do I want to help bringing Iceland out of this mess? Yes!

Interviewer: How?

Björgólfur Thor Björgólfsson: Can I do so now in any way? Can I bring money into the economy now? No. Can I assist in bringing in foreign currency? Yes, I can do that by liquidating some assets, it will take a long time, this crisis just has to be brought back on course before that happens. In short, I want to help and I believe I can help in many ways and I will. Let‘s not forget that last year I have been investing several billions in a new telephone network in Iceland benefitting all consumers and cutting all telephone costs; let‘s not forget that now the time has come to build a data center in Iceland consuming some 50 MW, which is an entire power project, an investment of ISK 60 billion in foreign cash, where I have foreign coinvestors. It is easier said than done to get foreign investors to invest in Iceland right now. They fear expropriation and generally the unrest and uncertainty about the country. So it is a giant task just to get the foreigners to come and invest in Iceland and then I mean real foreigners to invest in real projects bringing foreign currency into the contry and create jobs in Iceland, not some vultures that come and look upon Iceland as some carcass to pick up assets for peanuts.

Interviewer: You say you do not intend to bring money to Iceland, however there is this anger back home that shows up in discussions on the nationalisation of your assets, the freezing of assets, sales of businesses. This is indicative of the serious, grave undercurrent and massive anger. How do you respond to this?

Björgólfur Thor Björgólfsson: What assets will they take? Are they going to take a Polish telecom away from me, which is being developed? Do you think the State has got a better chance of selling it and then on what premises? And Actavis, I paid around ISK 400 billion into the economy last year. So I indebted the company, I carry those debts. Will the State take those debts over? They have received the money into the economy, will they take the debts over? This is totally overlooked. I have returned the money back home to Actavis, it came in cash, it stayed in the economy and it was in euros.

Interviewer: In a Forbes interview some years ago you said that wealth and power was of no importance, just respect and reputation, to quote Hávamál. What can you say about the Icelandic nation‘s view of you now, do you feel respect?

Björgólfur Thor Björgólfsson: I stand by my words at that time, this is what is most important to me and I fully realise that these two things have been enormously damaged and as for Iceland it will take a long time to make up for. But as with everything, I do it one day at a time, I tackle the problems, I do not run away from them and I do not shun responsibility. I will participate in the restoration in the years to come and I will regain what I have lost in respect.

In 2002 father and son Björgólfurs in partnership with Magnús Jónsson acquired Landsbanki for ISK 11.8 billion, a part of the sum they got for selling a beer brewery in Russia. Now, six years later, the IceSave deposit accounts have caused a severe international dispute with the British, Icelandic interests are linked to the al-Qaeda terrorist organisation and the Talibans, and furious Brits demand that each and every Icelander must guarantee millions of krónur.

Björgólfur Thor Björgólfsson: This is an assertion that we must contemplate a bit, arising as it is largely from the current claims that if worst comes to worst and if the guarantees fall on Iceland it may result in this. There is no certainty that this will fall on Iceland. Let‘s keep in mind that there were assets against all the banks‘ UK deposit accounts, even exceeding the deposits in value, and now we must handle it extremely carefully to convert those assets into cash to pay these people. I believe it is possible and I think that the risk of every person in Iceland must owe millions is just an exaggeration. It may come to that, but that is the most pessimistic prediction.

Interviewer: But what is happening to these assets?

Björgólfur Thor Björgólfsson: These assets are naturally here in England, in the hands of the British Central Bank or the UK Financial Services Authority.

Interviewer: Are you going to buy this now at a fire sale through Straumur?

Björgólfur Thor Björgólfsson: No, I am not about to buy, I haven‘t bought any of it. I believe you are referring to Straumur, which actually is not my company, it‘s got 20,000 shareholders, that yesterday bought the Teathers brand. They approached Straumur and actually asked if they could get a job there. So the only thing Straumur is doing is hiring people. I think they are just paying a small sum for the Teather brand as the Teathers brand has been destroyed and the Landsbanki brand has been destroyed through this nationalisation.

Interviewer: Who is responsible for all this IceSave business? You say that it has not been determined what guarantees will fall on Icelandic taxpayers but how is it possible for the Icelandic State and the Icelandic people to suddenly be guarantors for hundreds of billions of krónur?

Björgólfur Thor Björgólfsson: Actually there is quite a number of people that are responsible for this. Obviously the management of Landsbanki, the director and the board, come to mind but they had consulted the Financial Supervisory Authority of Iceland (FME) and the financial supervisory authorities of all countries. They did in all respects abide by the pertinent law and regulations and of course the head of the FME and the country‘s banking minister then must carry a lot of responsibility and I quite understand that he directs his accusations at us…

Interviewer: But wait, is it because these parties did not resist and said stop to you or Landsbanki‘s directors?

Björgólfur Thor Björgólfsson: For example, yes, for example. Why did, why…

Interviewer: Wait, are you saying that the authorities and the supervisory institutions are responsible because they did not stop you?

Björgólfur Thor Björgólfsson: No, I am saying something else. I am saying that the authorities carry a responsibility for how they tackled the issue, IceSave could have been tackled very differently so this IceSave issue would not be an issue but a part of a solution of this crisis that now has hit Iceland. And by that I mean that in a crisis like that the responses to the problems are actually more important and have greater consequences than the problem itself.

Interviewer: Wait just a minute, let‘s stick to these colossal sums that are being deposited into accounts on Icelandic guarantees, the origin of the problem, right? Isn‘t that the real issue instead of how a crisis is being reacted to later on?

Björgólfur Thor Björgólfsson: Yes, the origin of the problem is in fact that in 2006 Iceland was the first nation to be hit by a cash shortage, the cash crunch arrived in a lesser form in Iceland. In 2006 foreign banks began to doubt that the Icelandic banks could finance themselves, that they were too dependant upon wholesale loans abroad. It had become a lot. And then there was also that the Central Bank was too small to support them. It received much criticism and accounts began to close, financing avenues began to close, exactly what is happening to all banks now just happened to the Icelandic banks in 2006. And in 2006 people asked how to respond to this, with everybody participating. There were foreign rating companies, there were the banks, there were top specialists, control organisations and others that said: you must increase deposits, you must increase deposits, you cannot just rely on foreigners to lend you money. All right, deposits must increase. Now, there are only some 300,000 Icelanders so you cannot turn to Icelandic funds, so an overseas deposit system had to be implemented. And let‘s remember that in the latter half of 2006 these deposit systems that were started did fully rescue the Icelandic banking system from that crisis. In 2007 the Icelandic banks were applauded for this and Landsbanki had done most in this respect and had aquired most deposits. It was the most highly rated bank by the international rating companies and considered the least risky of the banks because of all the deposit accounts. Therefore the whole system, at home and abroad, told Landsbanki: this is the way, collect deposits and keep them. And here comes the question: how has this guarantee fallen on Iceland? Iceland joined the European Economic Area (EEA) a long time ago. It comes with responsibilities and burdens and this overseas expansion of the Icelandic enterprises enabling them to acquire this and that, this is all based on that agreement and when IceSave and the other systems actually became more popular than expected, and let‘s remember that IceSave and Landsbanki was not the only one to offer such online deposit accounts, there were numerous such companies, when they began to grow big people started saying shouldn‘t we start examining whether this should be an Icelandic or a foreign bank. And these talks were ongoing and transferring things over to England was being done, with these talks having been very far progressed, without reaching the goal, when in fact everything became disconnected that Monday by the nationalisation.

Interviewer: But isn‘t it just a gamble with the nation‘s very life that now explodes, breaks?

Björgólfur Thor Björgólfsson: I would never gamble or risk anything concerning Landsbanki on purpose.

Interviewer: But this stuation is obvious to everybody, it is nothing new that there are dark clouds gathering over the international financial markets, it has been going on for a year, it has been a difficult situation. At the same time these deposit accounts get bloated and they are guaranteed by Icelandic taxpayers, guaranteed by Icelanders. Wouldn‘t that be a gamble with the life?

Björgólfur Thor Björgólfsson: Firstly, during the first half of the year there were no indications that Landsbanki and all the Icelandic banks would be hit by the blows they are suffering from today so there was nothing wrong with receiving the deposits the way things were then. And secondly, I remind you of what I said a short while ago that there were more than enough assets against all these deposits. It doesn‘t mean at all that you are gambling with the nation‘s life if you have got assets against it all and this is always overlooked in the debate, those tremendous assets that existed against it all, which in fact the British financial supevisionary authority and the central bank have in their custody now.

Landsbanki was placed on UK‘s terrorism list along with al-Qaeda, Sudan, North Korea and the Taliban. The British demand the Icelandic nation to guarantee ISK hundreds of millions worth of Landsbanki‘s IceSave deposit accounts. A massive anger has risen among the Icelandic people towards father and son Björgólfurs. They demand nationalisation and expropriation, or at least a social and moral responsibility from them. Kristinn Hrafnsson interviewed Björgólfur Thor in London last Friday.

The nation‘s devastating economic collapse has generated massive anger among the nation, including towards the men who bought Landsbanki six years ago. In an interview last Friday the Prime Minister urged the tycoons to bring their wealth to Iceland to participate in the build-up and so did the Foreign Minister in TV program Kastljós. Earlier the Minister of Trade had referred to Björgólfur Thor saying that a social and moral duty rested on his shoulders to bring his money back to Iceland. The opposition parties want to examine the possibility of expropriation. Wrath and anger simmers among the people, with Björgólfur Thor being among those it is directed at. The animosity does not escape him even though he lives in London where Kompás met him last Friday.

Björgólfur Thor Björgólfsson, investor: I understand that people are angry now, as there is total uncertainty. Will this guarantee fall on Iceland? What is going to happen to the banks? What is going to happen concerning the loan? What is going to happen to the currency exchange? Iceland is in total uncertainty today. When there is uncertainty, total uncertainty, it manifests in two ways, fear and anger. And now people are just totally consumed by fear and anger and I fully understand that. I am both hurt and angry and scared. I mainly fear that the Icelandic authorities, when they took the measures they did, have not realised what forces they unleashed and I fear that they do not understand the long term effects of it on the economy and what remedies there are. I also want to point out concerning the remarks by (Minister of Trade) Björgvin (G. Sigurðsson), which I have not seen but heard of, that moral responsibility is a very subjective concept and I am not going to shun any responsibility, but it is not his to tell what the responsibility is. It is fine for him to direct the attention to us and away from himself. I am not going to personify, but I understand the anger and I think the key issue is: do I want to help bringing Iceland out of this mess? Yes!

Interviewer: How?

Björgólfur Thor Björgólfsson: Can I do so now in any way? Can I bring money into the economy now? No. Can I assist in bringing in foreign currency? Yes, I can do that by liquidating some assets, it will take a long time, this crisis just has to be brought back on course before that happens. In short, I want to help and I believe I can help in many ways and I will. Let‘s not forget that last year I have been investing several billions in a new telephone network in Iceland benefitting all consumers and cutting all telephone costs; let‘s not forget that now the time has come to build a data center in Iceland consuming some 50 MW, which is an entire power project, an investment of ISK 60 billion in foreign cash, where I have foreign coinvestors. It is easier said than done to get foreign investors to invest in Iceland right now. They fear expropriation and generally the unrest and uncertainty about the country. So it is a giant task just to get the foreigners to come and invest in Iceland and then I mean real foreigners to invest in real projects bringing foreign currency into the contry and create jobs in Iceland, not some vultures that come and look upon Iceland as some carcass to pick up assets for peanuts.

Interviewer: You say you do not intend to bring money to Iceland, however there is this anger back home that shows up in discussions on the nationalisation of your assets, the freezing of assets, sales of businesses. This is indicative of the serious, grave undercurrent and massive anger. How do you respond to this?

Björgólfur Thor Björgólfsson: What assets will they take? Are they going to take a Polish telecom away from me, which is being developed? Do you think the State has got a better chance of selling it and then on what premises? And Actavis, I paid around ISK 400 billion into the economy last year. So I indebted the company, I carry those debts. Will the State take those debts over? They have received the money into the economy, will they take the debts over? This is totally overlooked. I have returned the money back home to Actavis, it came in cash, it stayed in the economy and it was in euros.

Interviewer: In a Forbes interview some years ago you said that wealth and power was of no importance, just respect and reputation, to quote Hávamál. What can you say about the Icelandic nation‘s view of you now, do you feel respect?

Björgólfur Thor Björgólfsson: I stand by my words at that time, this is what is most important to me and I fully realise that these two things have been enormously damaged and as for Iceland it will take a long time to make up for. But as with everything, I do it one day at a time, I tackle the problems, I do not run away from them and I do not shun responsibility. I will participate in the restoration in the years to come and I will regain what I have lost in respect.

In 2002 father and son Björgólfurs in partnership with Magnús Jónsson acquired Landsbanki for ISK 11.8 billion, a part of the sum they got for selling a beer brewery in Russia. Now, six years later, the IceSave deposit accounts have caused a severe international dispute with the British, Icelandic interests are linked to the al-Qaeda terrorist organisation and the Talibans, and furious Brits demand that each and every Icelander must guarantee millions of krónur.

Björgólfur Thor Björgólfsson: This is an assertion that we must contemplate a bit, arising as it is largely from the current claims that if worst comes to worst and if the guarantees fall on Iceland it may result in this. There is no certainty that this will fall on Iceland. Let‘s keep in mind that there were assets against all the banks‘ UK deposit accounts, even exceeding the deposits in value, and now we must handle it extremely carefully to convert those assets into cash to pay these people. I believe it is possible and I think that the risk of every person in Iceland must owe millions is just an exaggeration. It may come to that, but that is the most pessimistic prediction.

Interviewer: But what is happening to these assets?

Björgólfur Thor Björgólfsson: These assets are naturally here in England, in the hands of the British Central Bank or the UK Financial Services Authority.

Interviewer: Are you going to buy this now at a fire sale through Straumur?

Björgólfur Thor Björgólfsson: No, I am not about to buy, I haven‘t bought any of it. I believe you are referring to Straumur, which actually is not my company, it‘s got 20,000 shareholders, that yesterday bought the Teathers brand. They approached Straumur and actually asked if they could get a job there. So the only thing Straumur is doing is hiring people. I think they are just paying a small sum for the Teather brand as the Teathers brand has been destroyed and the Landsbanki brand has been destroyed through this nationalisation.

Interviewer: Who is responsible for all this IceSave business? You say that it has not been determined what guarantees will fall on Icelandic taxpayers but how is it possible for the Icelandic State and the Icelandic people to suddenly be guarantors for hundreds of billions of krónur?

Björgólfur Thor Björgólfsson: Actually there is quite a number of people that are responsible for this. Obviously the management of Landsbanki, the director and the board, come to mind but they had consulted the Financial Supervisory Authority of Iceland (FME) and the financial supervisory authorities of all countries. They did in all respects abide by the pertinent law and regulations and of course the head of the FME and the country‘s banking minister then must carry a lot of responsibility and I quite understand that he directs his accusations at us…

Interviewer: But wait, is it because these parties did not resist and said stop to you or Landsbanki‘s directors?

Björgólfur Thor Björgólfsson: For example, yes, for example. Why did, why…

Interviewer: Wait, are you saying that the authorities and the supervisory institutions are responsible because they did not stop you?

Björgólfur Thor Björgólfsson: No, I am saying something else. I am saying that the authorities carry a responsibility for how they tackled the issue, IceSave could have been tackled very differently so this IceSave issue would not be an issue but a part of a solution of this crisis that now has hit Iceland. And by that I mean that in a crisis like that the responses to the problems are actually more important and have greater consequences than the problem itself.

Interviewer: Wait just a minute, let‘s stick to these colossal sums that are being deposited into accounts on Icelandic guarantees, the origin of the problem, right? Isn‘t that the real issue instead of how a crisis is being reacted to later on?

Björgólfur Thor Björgólfsson: Yes, the origin of the problem is in fact that in 2006 Iceland was the first nation to be hit by a cash shortage, the cash crunch arrived in a lesser form in Iceland. In 2006 foreign banks began to doubt that the Icelandic banks could finance themselves, that they were too dependant upon wholesale loans abroad. It had become a lot. And then there was also that the Central Bank was too small to support them. It received much criticism and accounts began to close, financing avenues began to close, exactly what is happening to all banks now just happened to the Icelandic banks in 2006. And in 2006 people asked how to respond to this, with everybody participating. There were foreign rating companies, there were the banks, there were top specialists, control organisations and others that said: you must increase deposits, you must increase deposits, you cannot just rely on foreigners to lend you money. All right, deposits must increase. Now, there are only some 300,000 Icelanders so you cannot turn to Icelandic funds, so an overseas deposit system had to be implemented. And let‘s remember that in the latter half of 2006 these deposit systems that were started did fully rescue the Icelandic banking system from that crisis. In 2007 the Icelandic banks were applauded for this and Landsbanki had done most in this respect and had aquired most deposits. It was the most highly rated bank by the international rating companies and considered the least risky of the banks because of all the deposit accounts. Therefore the whole system, at home and abroad, told Landsbanki: this is the way, collect deposits and keep them. And here comes the question: how has this guarantee fallen on Iceland? Iceland joined the European Economic Area (EEA) a long time ago. It comes with responsibilities and burdens and this overseas expansion of the Icelandic enterprises enabling them to acquire this and that, this is all based on that agreement and when IceSave and the other systems actually became more popular than expected, and let‘s remember that IceSave and Landsbanki was not the only one to offer such online deposit accounts, there were numerous such companies, when they began to grow big people started saying shouldn‘t we start examining whether this should be an Icelandic or a foreign bank. And these talks were ongoing and transferring things over to England was being done, with these talks having been very far progressed, without reaching the goal, when in fact everything became disconnected that Monday by the nationalisation.

Interviewer: But isn‘t it just a gamble with the nation‘s very life that now explodes, breaks?

Björgólfur Thor Björgólfsson: I would never gamble or risk anything concerning Landsbanki on purpose.

Interviewer: But this stuation is obvious to everybody, it is nothing new that there are dark clouds gathering over the international financial markets, it has been going on for a year, it has been a difficult situation. At the same time these deposit accounts get bloated and they are guaranteed by Icelandic taxpayers, guaranteed by Icelanders. Wouldn‘t that be a gamble with the life?

Björgólfur Thor Björgólfsson: Firstly, during the first half of the year there were no indications that Landsbanki and all the Icelandic banks would be hit by the blows they are suffering from today so there was nothing wrong with receiving the deposits the way things were then. And secondly, I remind you of what I said a short while ago that there were more than enough assets against all these deposits. It doesn‘t mean at all that you are gambling with the nation‘s life if you have got assets against it all and this is always overlooked in the debate, those tremendous assets that existed against it all, which in fact the British financial supevisionary authority and the central bank have in their custody now.

_________________

ООО "АйсКорпо Рус" www.icecorpo.is

Школа русского языка в Исландии www.modurmal.com

Re: Iceland’s richest man defends economic record

Re: Iceland’s richest man defends economic record

Interviewer: You mention the responsibility of Landsbanki‘s directors, Halldór (J. Kristjánsson) and Sigurjón (Árnason), did they fail you?

Björgólfur Thor Björgólfsson: I am naturally enormously disappointed about how the whole thing has developed. I am not going to personify those disappointments.

Interviewer: They are the directors of Landsbanki.

Björgólfur Thor Björgólfsson: They are the directors of Landsbanki.

Interviewer: When you say that Landsbanki‘s directors have failed, how did it happen and who…?

Björgólfur Thor Björgólfsson: I did not say that they had failed, I just say that perhaps the more pessimistic plans should have been considered and such. It is naturally always easy to be wise afterwards, but I just want to mention that as a large shareholder in a company you can often wield much influence, but as a large shareholder in a bank you actually have very little influence. Banks are institutions that are subjected to a huge regulatory apparatus, i.e. the Financial Supervisory Authority (FME), the banking supervisory authority, the Central Bank, foreign credit rating institutions and the law specifically stipulates that the owners are not allowed to interfere with the operation. All cases are subjected to bank privacy so you have a very limited influence over the operation as a large shareholder in a bank. So it is a general misconception that as a large shareholder in a bank you can exert much influence, you have less influence than usual. You can formulate a policy and the formulated policy was to enter into offering deposit accounts abroad, and it was formulated by the bank‘s management and board. Whether it has proven right or wrong will be decided once it‘s clear what amounts can be realised to pay the IceSave debts. I was not a member of the board and I was not a managing director of the bank.

Interviewer: Do you expect the public to believe that you could not have intervened there?

Björgólfur Thor Björgólfsson: I could not intervene, it just was not in my power to do so. I really wish I could have.

Björgólfur Thor Björgólfsson: I am naturally enormously disappointed about how the whole thing has developed. I am not going to personify those disappointments.

Interviewer: They are the directors of Landsbanki.

Björgólfur Thor Björgólfsson: They are the directors of Landsbanki.

Interviewer: When you say that Landsbanki‘s directors have failed, how did it happen and who…?

Björgólfur Thor Björgólfsson: I did not say that they had failed, I just say that perhaps the more pessimistic plans should have been considered and such. It is naturally always easy to be wise afterwards, but I just want to mention that as a large shareholder in a company you can often wield much influence, but as a large shareholder in a bank you actually have very little influence. Banks are institutions that are subjected to a huge regulatory apparatus, i.e. the Financial Supervisory Authority (FME), the banking supervisory authority, the Central Bank, foreign credit rating institutions and the law specifically stipulates that the owners are not allowed to interfere with the operation. All cases are subjected to bank privacy so you have a very limited influence over the operation as a large shareholder in a bank. So it is a general misconception that as a large shareholder in a bank you can exert much influence, you have less influence than usual. You can formulate a policy and the formulated policy was to enter into offering deposit accounts abroad, and it was formulated by the bank‘s management and board. Whether it has proven right or wrong will be decided once it‘s clear what amounts can be realised to pay the IceSave debts. I was not a member of the board and I was not a managing director of the bank.

Interviewer: Do you expect the public to believe that you could not have intervened there?

Björgólfur Thor Björgólfsson: I could not intervene, it just was not in my power to do so. I really wish I could have.

_________________

ООО "АйсКорпо Рус" www.icecorpo.is

Школа русского языка в Исландии www.modurmal.com

Re: Iceland’s richest man defends economic record

Re: Iceland’s richest man defends economic record

Here Björgólfur Thor reveals for the first time that the day before the Emergency Act was approved in Iceland, the British had made an about-face and offered to accept IceSave under a British guarantee in 5 days against a guarantee from the Central Bank of Iceland. This had been rejected by the Central Bank, resulting in the collapse of the remainder of the Icelandic banking system and the country plunging into a harsh international dispute. Björgólfur Thor asserts that the previous weekend the authorities had not even replied to offers that would have stopped the nationalisation of Glitnir and prevented the banking system‘s fateful collapse.

The monetary policy is criticised for creating a false value of the króna. Were the good economic times just a castle made of sand, people are asking. The foreign expansion is criticised for being more a circulation than expansion. The foreign expansion „vikings“ claim to have adhered to law and regulations, used cheap credit but now it has come to light that their foreign investments were to a large degree paid by Icelandic banks. Björgólfur Thor refuses to be classified as a foreign expansion „viking“. He says he has invested abroad for foreign funds which he had earned himself or borrowed from foreign banks. He criticises those self same „vikings“ that inflated the value of their companies through buying and selling between related parties at ever increasing prices for the sole purpose of increasing further borrowing possibilities.

Björgólfur Thor Björgólfsson: I think you newspeople have done a thorough job in detailing the foreign expansion „vikings“. I do not define myself as a foreign expansion.

Interviewer: Why not?

Björgólfur Thor Björgólfsson: Firstly, see, I have lived abroad for 21 years, more than half of my life. I do not have Icelandic funds to invest with abroad. I am totally different from all of those that have grown up there and become ambitious these past five years in this foreign expansion bubble, as it has been called, for the simple reason that I earned my capital abroad. The difference between me and the others is that they have started their businesses in Iceland, leveraged their own funds in Iceland to acquire businesses abroad. The more their assets grow in value in Iceland, the more they leverage in Iceland to buy more abroad. This is the great difference. I work and started abroad and am as such. Of course my roots are in Iceland.

Interviewer: But you are not in league with the others, that‘s what you are saying. You brought money to the country. They were siphoning money out of the country.

Björgólfur Thor Björgólfsson: I brought money into the country.

Interviewer: Isn‘t this weakening the foundations of the Icelandic economy?

Björgólfur Thor Björgólfsson: It isn‘t mine to give examples of that, but I just believe the figures speak for themselves. And I cannot see but that this thorough navel-gazing the Icelandic society and Icelandic business sector is going through today will bring that into light and let the figures speak for themselves.

Interviewer: Why can‘t you make a judgement on that because this concerns your interests. It concerns the interests of all those involved in the Icelandic economy.

Björgólfur Thor Björgólfsson: Yes of course. I believe that the high-profile players in business during the past years, myself included in bringing money into the country or the others who were moving money out of the country, they clearly have some responsibility for themselves; I think it is the joint responsibility of many that is causing this situation today and I am not going to run away from that.

Interviewer: Isn‘t this business model a factor in upsetting everything together with the Central Bank‘s monetary policy and an international credit crisis, as you say?

Björgólfur Thor Björgólfsson: That may be so, but there are two things in this. Firstly when people are creating equity by selling assets to each other within a closed group. This is naturally just a circulation. It is inherently just nonsense.

Interviewer: Isn‘t it just a pyramid scheme?

Björgólfur Thor Björgólfsson: I wouldn‘t go so far, but I would say it is nonsense. When you create equity by buying from and selling to yourself, it naturally doesn‘t add up in the long run, when they are making headlines concerning profits, large profits and such and the sale of that company to the other which in fact is just a case of refinancing. There never comes in any cash. Maybe that is where I differ, when I sell my companies in Russia, in Bulgaria, in the Czech Republic, I have been paid in cash. It is not just documents changing hands. And when I paid for Actavis and bought Actavis I paid with cash to Iceland. An it is naturally also when they go on the market and sell, take their equity and place some multiplying factor on it, a doubling of the equity, and people buy this, then something is created, some equity, that will also be difficult to utilise in times of crisis.

Interviewer: Who bought a stake in Straumur a year ago?

Björgólfur Thor Björgólfsson: A year ago?

Interviewer: 10 billion. There was talk about a takeover obligation being created. Was it you or parties related to you?

Björgólfur Thor Björgólfsson: No, that was not us.

Interviewer: Who sold their shares in Landsbanki just before it collapsed?

Björgólfur Thor Björgólfsson: I am not aware of who sold, but just to have one thing clear, I have never sold a single share in Landsbanki or Straumur. I have never taken any money off the table, I have only brought money into these companies and we have never sold.

Interviewer: Are you selling Actavis?

Björgólfur Thor Björgólfsson: No, I am not selling Actavis at this time. I am trying to make it valuable and I think everybody realises that now is no time to sell businesses.

Interviewer: Did you have anything to do with this request for credit from Russia?

Björgólfur Thor Björgólfsson: No, I had nothing to do with it.

Interviewer: What about the political responsibility for the final run during these fateful days when everything collapsed in Iceland?

Björgólfur Thor Björgólfsson: Look, firstly, as I have said, this monetary policy in Iceland has been useless, it has resulted in much too high an interest rate. It has resulted in people consuming beyond their means through borrowing abroad. And it has resulted in the whole national production being paid out of the country to some unnamed investment funds abroad. I have repeatedly warned against this. Last Christmas I was interviewed in (TV program) Kastljós, where I asked the simple question if we Icelanders can afford to have the Icelandic króna currency. It is not a question of whether we want to but can we afford to. It has become apparent that we cannot afford to have it. The most serious problem and what everybody miscalculated is how much does it cost to try and keep an independent currency in times of crisis. That‘s what nobody bargained for and now it has shown itself to be the most costly part of this all.

The collapse will be costly and Björgólfur Thor believes that the authorities, the government and the Central Bank, are responsible for a terrible chain of events. A completely wrong course had been taken by taking Glitnir over on that fateful Monday of 29 September.

The monetary policy is criticised for creating a false value of the króna. Were the good economic times just a castle made of sand, people are asking. The foreign expansion is criticised for being more a circulation than expansion. The foreign expansion „vikings“ claim to have adhered to law and regulations, used cheap credit but now it has come to light that their foreign investments were to a large degree paid by Icelandic banks. Björgólfur Thor refuses to be classified as a foreign expansion „viking“. He says he has invested abroad for foreign funds which he had earned himself or borrowed from foreign banks. He criticises those self same „vikings“ that inflated the value of their companies through buying and selling between related parties at ever increasing prices for the sole purpose of increasing further borrowing possibilities.

Björgólfur Thor Björgólfsson: I think you newspeople have done a thorough job in detailing the foreign expansion „vikings“. I do not define myself as a foreign expansion.

Interviewer: Why not?

Björgólfur Thor Björgólfsson: Firstly, see, I have lived abroad for 21 years, more than half of my life. I do not have Icelandic funds to invest with abroad. I am totally different from all of those that have grown up there and become ambitious these past five years in this foreign expansion bubble, as it has been called, for the simple reason that I earned my capital abroad. The difference between me and the others is that they have started their businesses in Iceland, leveraged their own funds in Iceland to acquire businesses abroad. The more their assets grow in value in Iceland, the more they leverage in Iceland to buy more abroad. This is the great difference. I work and started abroad and am as such. Of course my roots are in Iceland.

Interviewer: But you are not in league with the others, that‘s what you are saying. You brought money to the country. They were siphoning money out of the country.

Björgólfur Thor Björgólfsson: I brought money into the country.

Interviewer: Isn‘t this weakening the foundations of the Icelandic economy?

Björgólfur Thor Björgólfsson: It isn‘t mine to give examples of that, but I just believe the figures speak for themselves. And I cannot see but that this thorough navel-gazing the Icelandic society and Icelandic business sector is going through today will bring that into light and let the figures speak for themselves.

Interviewer: Why can‘t you make a judgement on that because this concerns your interests. It concerns the interests of all those involved in the Icelandic economy.

Björgólfur Thor Björgólfsson: Yes of course. I believe that the high-profile players in business during the past years, myself included in bringing money into the country or the others who were moving money out of the country, they clearly have some responsibility for themselves; I think it is the joint responsibility of many that is causing this situation today and I am not going to run away from that.

Interviewer: Isn‘t this business model a factor in upsetting everything together with the Central Bank‘s monetary policy and an international credit crisis, as you say?

Björgólfur Thor Björgólfsson: That may be so, but there are two things in this. Firstly when people are creating equity by selling assets to each other within a closed group. This is naturally just a circulation. It is inherently just nonsense.

Interviewer: Isn‘t it just a pyramid scheme?

Björgólfur Thor Björgólfsson: I wouldn‘t go so far, but I would say it is nonsense. When you create equity by buying from and selling to yourself, it naturally doesn‘t add up in the long run, when they are making headlines concerning profits, large profits and such and the sale of that company to the other which in fact is just a case of refinancing. There never comes in any cash. Maybe that is where I differ, when I sell my companies in Russia, in Bulgaria, in the Czech Republic, I have been paid in cash. It is not just documents changing hands. And when I paid for Actavis and bought Actavis I paid with cash to Iceland. An it is naturally also when they go on the market and sell, take their equity and place some multiplying factor on it, a doubling of the equity, and people buy this, then something is created, some equity, that will also be difficult to utilise in times of crisis.

Interviewer: Who bought a stake in Straumur a year ago?

Björgólfur Thor Björgólfsson: A year ago?

Interviewer: 10 billion. There was talk about a takeover obligation being created. Was it you or parties related to you?

Björgólfur Thor Björgólfsson: No, that was not us.

Interviewer: Who sold their shares in Landsbanki just before it collapsed?

Björgólfur Thor Björgólfsson: I am not aware of who sold, but just to have one thing clear, I have never sold a single share in Landsbanki or Straumur. I have never taken any money off the table, I have only brought money into these companies and we have never sold.

Interviewer: Are you selling Actavis?

Björgólfur Thor Björgólfsson: No, I am not selling Actavis at this time. I am trying to make it valuable and I think everybody realises that now is no time to sell businesses.

Interviewer: Did you have anything to do with this request for credit from Russia?

Björgólfur Thor Björgólfsson: No, I had nothing to do with it.

Interviewer: What about the political responsibility for the final run during these fateful days when everything collapsed in Iceland?

Björgólfur Thor Björgólfsson: Look, firstly, as I have said, this monetary policy in Iceland has been useless, it has resulted in much too high an interest rate. It has resulted in people consuming beyond their means through borrowing abroad. And it has resulted in the whole national production being paid out of the country to some unnamed investment funds abroad. I have repeatedly warned against this. Last Christmas I was interviewed in (TV program) Kastljós, where I asked the simple question if we Icelanders can afford to have the Icelandic króna currency. It is not a question of whether we want to but can we afford to. It has become apparent that we cannot afford to have it. The most serious problem and what everybody miscalculated is how much does it cost to try and keep an independent currency in times of crisis. That‘s what nobody bargained for and now it has shown itself to be the most costly part of this all.

The collapse will be costly and Björgólfur Thor believes that the authorities, the government and the Central Bank, are responsible for a terrible chain of events. A completely wrong course had been taken by taking Glitnir over on that fateful Monday of 29 September.

_________________

ООО "АйсКорпо Рус" www.icecorpo.is

Школа русского языка в Исландии www.modurmal.com

Re: Iceland’s richest man defends economic record

Re: Iceland’s richest man defends economic record

Björgólfur Thor Björgólfsson: This was a terrible chain of events , a terrible chain of events resulting in a disaster. It is the disaster we are in today as a nation. I was incidentally in Iceland at a wedding when I received a phonecall from people telling me that Glitnir had run into trouble and that the Central Bank will probably attempt to take it over. Then all kinds of discussions started and Landsbanki‘s shareholders were asked to talk with Glitnir‘s shareholders and talk with the Central Bank … There the State is about to take over a bank. By taking over the whole bank the State is assuming the whole responsibility. This must not happen. This was the message from Landsbanki and Kaupþing that were outside this, this must not happen, this is terrible. Then private enterprise, i.e. the banks, came up with ideas and we submitted them to the PM, we submitted them to the Central Bank on that Sunday, we repeated them the following Monday and we always made changes, we got no reply. I am not saying that they were rejected, we just received no answers, they were not considered worthy of reply. And our suggestions were inherently exactly the same suggestions that were made here in England, i.e. to effect the merger of all the banks, Landsbanki/Glitnir/ and Landsbanki/Glitnir/Straumur, all to be merged, to aggregate their equity to cut costs with the State also injecting capital and acquiring a majority stake, yet not become responsible. Now everybody is saying: how is the State responsible. Our proposals all aimed at trying to prevent Icelanders and the state of Iceland from having to assume responsibility. That is what is the worst thing about this, the chain of events and the decision made by the State resulting in itself becoming responsible, made all Icelanders responsible for the debts. That is the worst thing. We tried our utmost to prevent this. So this Glitnir-move on that Monday was such an ill-judged decision that it will be remembered for years to come for its lack of judgement as it started a chain of events that has ended in a disaster.

What happened as a result was foreseeable, Björgólfur Thor says. The other banks and the State Treasury lost credibility abroad and the following weekend, on 4 and 5 October, crisis meetings were held in the governmental meeting house, Ráðherrabústaðurinn.

Björgólfur Thor Björgólfsson: We were sitting in the house next door, the directors of Landsbanki and me as a Landsbanki shareholder as well as Kaupþing‘s largest shareholders and directors, who all were ready to work. We submitted a joint proposal. Again, it was not rejected, it was not answered. We were not answered and there never came anybody from the State, neither during this weekend nor the one before, saying „this proposal is fine in this part and not so good in the other, we want to change it, you have to do it this way“. There were no discussions, they just didn‘t talk to us. Somehow there is a lack of supervision or something, people do not talk and messages do not get delivered. Somehow the weekend just came to an end, everybody has spoken and been spoken to and talked and talked but no decisions have been made on any solutions. Then around midnight the solution is presented on TV, nothing is to be done. Finished, everybody goes home. Then the following day there was a direct transmission from the government, saying so with a black frame and white letters as in a funeral. And now the uncertainties are going to be removed, resulting in creating much greater uncertainties than ever before, which is still going on today.

PM Geir Haarde addressed the nation on 6 October: „There is real danger, my fellow countrymen, that the Icelandic economy could, if worst comes to worst, be sucked into the turbulence along with the banks resulting in a national bankruptcy“.

In the days just before the weekend, the British had been increasingly concerned about IceSave. In Björgólfur Thor‘s opinion, the UK Financial Services Authority was being unyielding in demanding enormous sums as guarantees. During Sunday its tone had changed completely and Björgólfur Thor believes the UK government had decided to make an all out effort to bring IceSave under its protection within days against a GBP 200 million security. That was a much lower sum than previously demanded. On that black Monday of 6 October, it became apparent that the Central Bank was not going to approach Landsbanki‘s proposals. In Björgólfur Thor‘s opinion that explains Alistair darling‘s phone conversation with Árni Mathiesen on Tuesday the 7th, released on TV last week and Darling‘s and Brown‘s violent responses on Wednesday the 8th. But when the government was sitting on long meetings in the Ráðherrabústaður house, Björgólfur Thor believes the British state had made an about-turn and decided to extend a helping hand.

Björgólfur Thor Björgólfsson: On Sunday there occured a total turnaround with the UK Financial Services Authority. It said: „Look, we are ready to totally speed up your application to become incorporated in England so all the IceSave responsibility is transferred over to the British State“. This had been attempted for a long time and there on that Sunday comes the total turning point. Then the British State, which until then had been reluctant and very disagreeable in all relations, returns with a new policy: „We are going to let you through in 5 days. We are going to give IceSave a fast track into British jurisdiction“.

Interviewer: And out of Icelandic guarantee.

Björgólfur Thor Björgólfsson: Out of Icelandic guarantee.

Interviewer: In 5 days.

Björgólfur Thor Björgólfsson: In 5 days. They talked about 5 days, one week and 5 working days. And it was on the condition that Landsbanki would deposit GBP 200 million as a guarantee at noon on Monday. This is a total turning point and as an indication of how much a turning point it was the director of the UK Financial Services Authority, Hector Sants, himself entered the case. He participated in all teleconferences, he was summoned on Sunday, he entered the case. He was the one talking with Landsbanki. This shows the severity of this case and in my opinion it also demonstrates that the British government has found it necessary to summon him and get him personally involved. So on that Monday we needed 200 million to be able to bring this into UK jurisdiction. We asked for it on Sunday and were in the good faith that we would get the sum and pay it on Monday, to bring it into British jurisdiction of course. Then the following Monday morning we received no reply from the Central Bank. Not at 8 o‘clock, not at 9, no reply at 10 o‘clock, no reply at 11 o‘clock. Then comes the time we must pay to the UK Financial Services Authority at 12 o‘clock, it passes and still no reply. Half an hour later we received a reply from the Central Bank: „You will not get that help“. Just so that people can understand it. It was a EUR 500 million assistance. Landsbanki offered guarantees amounting to EUR 2,600, five times the requested amount. Meaning they requested a loan with guarantees five times the sum as collateral.

Interviewer: What kind of collateral was this?

Björgólfur Thor Björgólfsson: Collateral? It consisted of government bonds, both Icelandic and German, the most secure collateral there is. These were payments of EUR 500 million guaranteed to be paid by the Icelandic pension funds. The best collateral imaginable. We did not get this service, we didn‘t. And at the same time Kaupþing gets 500 million against a collateral of one thousand. They brought a collateral of double the amount, we offered five times the amount as collateral. They get a 500 million loan and what‘s more, their collateral was shares in an unlisted financial services company in Denmark. This is totally incomprehensible to me, totally, and I believe that if this matter had been thought through and cooperated on, IceSave would have been brought into British jurisdiction and we had not entered these difficulties and this dispute with Britain. That is my opinion and I find it infinitely sad that this happened the way it did.

Interviewer: Sad, is that the correct description as regards the Central Bank‘s responsibility, in your opinion?

Björgólfur Thor Björgólfsson: I am not going to comment on the responsibility of the State. During this interview I have consistently mentioned the State, and then I make no distinction between the government, the Parliament, the Central Bank and other offices, I call it the State. And I am not going to personify anything here and yes, in my opinion this whole affair is just sad and that this opportunity was just wasted. It is just terrible.

Interviewer: You get a negative reply at noon, later that day the PM asks God to bless the nation and says there is a risk of a national bankruptcy. Is that why you received no as an answer?

Björgólfur Thor Björgólfsson: I don‘t know. Like I said, I ceased being able to figure out what was happening ever since I watched TV that Sunday night, being told that there was no need for action. Then I ceased to understand what is going on and have been unable to ever since.

Interviewer: The conversation between Árni Mathiesen and Alistair Darling, yesterday leaked to Icelandic media, which created this rage and reaction here in the UK, in what way does that conversation explain the chain of events, in your opinion?

Björgólfur Thor Björgólfsson: Well, in my opinion the UK Financial Services Authority, an institution of that kind summoning its director and involving him personally and making such an about-turn on a Sunday and working late into the evening, cannot have done this unless some political intervention was made. I cannot imagine that could have come about in some collusion between the two countries. I believe the British reacted erroneously and too violently. I agree with the nation there but I also believe the British had been in the expectation that this was to be solved jointly. I think the British had built up expectations and that when they didn‘t receive those promised 200 millions on that Monday, which Landsbanki had promised on the condition of a State support, they were in the faith that the countries would do this together. So when it comes as a slap in the face that this was not going to be kept on Monday, I fully understand that the British had simply become furious.

PM Geir Haarde addresses the nation on 6 October: „Big and wealthy banks on both sides of the Atlantic have become victims of the crisis and governments in many countries are fighting for their life in saving what can be saved at home“.

Björgólfur Thor Björgólfsson: I have experienced exactly this kind of crisis myself. In ´98 I was in Russia when the PM appeared on TV on a Monday saying that Russia was unable to pay its debts as a nation and the country collapsed. Total chaos ensued for a whole year and it took several years for Russia to work its way out of this. There I was on the ground, friends, colleagues and others, credit cards didn‘t function, the rouble dropped like a brick. The exact same thing happened as in Iceland, except in a harsher way. I was at the scene, I had a job, I was able to work myself out of it, the Russians were able to work their way out of it, Iceland will do the same. I have seen this before.

icenews.is

What happened as a result was foreseeable, Björgólfur Thor says. The other banks and the State Treasury lost credibility abroad and the following weekend, on 4 and 5 October, crisis meetings were held in the governmental meeting house, Ráðherrabústaðurinn.

Björgólfur Thor Björgólfsson: We were sitting in the house next door, the directors of Landsbanki and me as a Landsbanki shareholder as well as Kaupþing‘s largest shareholders and directors, who all were ready to work. We submitted a joint proposal. Again, it was not rejected, it was not answered. We were not answered and there never came anybody from the State, neither during this weekend nor the one before, saying „this proposal is fine in this part and not so good in the other, we want to change it, you have to do it this way“. There were no discussions, they just didn‘t talk to us. Somehow there is a lack of supervision or something, people do not talk and messages do not get delivered. Somehow the weekend just came to an end, everybody has spoken and been spoken to and talked and talked but no decisions have been made on any solutions. Then around midnight the solution is presented on TV, nothing is to be done. Finished, everybody goes home. Then the following day there was a direct transmission from the government, saying so with a black frame and white letters as in a funeral. And now the uncertainties are going to be removed, resulting in creating much greater uncertainties than ever before, which is still going on today.

PM Geir Haarde addressed the nation on 6 October: „There is real danger, my fellow countrymen, that the Icelandic economy could, if worst comes to worst, be sucked into the turbulence along with the banks resulting in a national bankruptcy“.

In the days just before the weekend, the British had been increasingly concerned about IceSave. In Björgólfur Thor‘s opinion, the UK Financial Services Authority was being unyielding in demanding enormous sums as guarantees. During Sunday its tone had changed completely and Björgólfur Thor believes the UK government had decided to make an all out effort to bring IceSave under its protection within days against a GBP 200 million security. That was a much lower sum than previously demanded. On that black Monday of 6 October, it became apparent that the Central Bank was not going to approach Landsbanki‘s proposals. In Björgólfur Thor‘s opinion that explains Alistair darling‘s phone conversation with Árni Mathiesen on Tuesday the 7th, released on TV last week and Darling‘s and Brown‘s violent responses on Wednesday the 8th. But when the government was sitting on long meetings in the Ráðherrabústaður house, Björgólfur Thor believes the British state had made an about-turn and decided to extend a helping hand.

Björgólfur Thor Björgólfsson: On Sunday there occured a total turnaround with the UK Financial Services Authority. It said: „Look, we are ready to totally speed up your application to become incorporated in England so all the IceSave responsibility is transferred over to the British State“. This had been attempted for a long time and there on that Sunday comes the total turning point. Then the British State, which until then had been reluctant and very disagreeable in all relations, returns with a new policy: „We are going to let you through in 5 days. We are going to give IceSave a fast track into British jurisdiction“.

Interviewer: And out of Icelandic guarantee.

Björgólfur Thor Björgólfsson: Out of Icelandic guarantee.

Interviewer: In 5 days.

Björgólfur Thor Björgólfsson: In 5 days. They talked about 5 days, one week and 5 working days. And it was on the condition that Landsbanki would deposit GBP 200 million as a guarantee at noon on Monday. This is a total turning point and as an indication of how much a turning point it was the director of the UK Financial Services Authority, Hector Sants, himself entered the case. He participated in all teleconferences, he was summoned on Sunday, he entered the case. He was the one talking with Landsbanki. This shows the severity of this case and in my opinion it also demonstrates that the British government has found it necessary to summon him and get him personally involved. So on that Monday we needed 200 million to be able to bring this into UK jurisdiction. We asked for it on Sunday and were in the good faith that we would get the sum and pay it on Monday, to bring it into British jurisdiction of course. Then the following Monday morning we received no reply from the Central Bank. Not at 8 o‘clock, not at 9, no reply at 10 o‘clock, no reply at 11 o‘clock. Then comes the time we must pay to the UK Financial Services Authority at 12 o‘clock, it passes and still no reply. Half an hour later we received a reply from the Central Bank: „You will not get that help“. Just so that people can understand it. It was a EUR 500 million assistance. Landsbanki offered guarantees amounting to EUR 2,600, five times the requested amount. Meaning they requested a loan with guarantees five times the sum as collateral.

Interviewer: What kind of collateral was this?

Björgólfur Thor Björgólfsson: Collateral? It consisted of government bonds, both Icelandic and German, the most secure collateral there is. These were payments of EUR 500 million guaranteed to be paid by the Icelandic pension funds. The best collateral imaginable. We did not get this service, we didn‘t. And at the same time Kaupþing gets 500 million against a collateral of one thousand. They brought a collateral of double the amount, we offered five times the amount as collateral. They get a 500 million loan and what‘s more, their collateral was shares in an unlisted financial services company in Denmark. This is totally incomprehensible to me, totally, and I believe that if this matter had been thought through and cooperated on, IceSave would have been brought into British jurisdiction and we had not entered these difficulties and this dispute with Britain. That is my opinion and I find it infinitely sad that this happened the way it did.

Interviewer: Sad, is that the correct description as regards the Central Bank‘s responsibility, in your opinion?

Björgólfur Thor Björgólfsson: I am not going to comment on the responsibility of the State. During this interview I have consistently mentioned the State, and then I make no distinction between the government, the Parliament, the Central Bank and other offices, I call it the State. And I am not going to personify anything here and yes, in my opinion this whole affair is just sad and that this opportunity was just wasted. It is just terrible.

Interviewer: You get a negative reply at noon, later that day the PM asks God to bless the nation and says there is a risk of a national bankruptcy. Is that why you received no as an answer?

Björgólfur Thor Björgólfsson: I don‘t know. Like I said, I ceased being able to figure out what was happening ever since I watched TV that Sunday night, being told that there was no need for action. Then I ceased to understand what is going on and have been unable to ever since.

Interviewer: The conversation between Árni Mathiesen and Alistair Darling, yesterday leaked to Icelandic media, which created this rage and reaction here in the UK, in what way does that conversation explain the chain of events, in your opinion?

Björgólfur Thor Björgólfsson: Well, in my opinion the UK Financial Services Authority, an institution of that kind summoning its director and involving him personally and making such an about-turn on a Sunday and working late into the evening, cannot have done this unless some political intervention was made. I cannot imagine that could have come about in some collusion between the two countries. I believe the British reacted erroneously and too violently. I agree with the nation there but I also believe the British had been in the expectation that this was to be solved jointly. I think the British had built up expectations and that when they didn‘t receive those promised 200 millions on that Monday, which Landsbanki had promised on the condition of a State support, they were in the faith that the countries would do this together. So when it comes as a slap in the face that this was not going to be kept on Monday, I fully understand that the British had simply become furious.

PM Geir Haarde addresses the nation on 6 October: „Big and wealthy banks on both sides of the Atlantic have become victims of the crisis and governments in many countries are fighting for their life in saving what can be saved at home“.

Björgólfur Thor Björgólfsson: I have experienced exactly this kind of crisis myself. In ´98 I was in Russia when the PM appeared on TV on a Monday saying that Russia was unable to pay its debts as a nation and the country collapsed. Total chaos ensued for a whole year and it took several years for Russia to work its way out of this. There I was on the ground, friends, colleagues and others, credit cards didn‘t function, the rouble dropped like a brick. The exact same thing happened as in Iceland, except in a harsher way. I was at the scene, I had a job, I was able to work myself out of it, the Russians were able to work their way out of it, Iceland will do the same. I have seen this before.

icenews.is

_________________

ООО "АйсКорпо Рус" www.icecorpo.is

Школа русского языка в Исландии www.modurmal.com

Страница 1 из 1

Права доступа к этому форуму:

Вы не можете отвечать на сообщения|

|

|

» Тиманский овраг

» Отель "Ореанда"

» Карельские рассветы

» Альма-Матер

» Две вдовы Маленького Принца

» Самый сочный шашлык - рецепты, маринады и другие хитрости

» Сентябрь в Алустосе

» Кронштадтский тупик

» Говяжий язык